The explosive growth of the mobile Internet has made contactless payment penetrate into our daily life. As expectations grow for secure and integrated payment for any service or product, so does the discussion around the mobile payment. Due to the COVID-19 pandemic, effective integration of contactless payment with the in-store experience has become a hot topic. Advanced wireless and proximity technologies offer people a new way to adopt digital and mobile payments. In this aspect, you’ll see the tremendous capacity and power of short-range wireless technologies like Bluetooth. This post will look at how BLE technology revamps contactless payment.

What is Bluetooth contactless payment

Bluetooth contactless payment refers to wireless transactions made by tapping on a contactless chip card or payment-enabled device over the Bluetooth-enabled checkout terminal that supports contactless payment. Cards, mobile devices, and watches can all leverage BLE technology to provide customers with a seamless and frictionless contactless payment experience. When you choose BLE payment, the transaction is touch-free, convenient, and secure.

The combination of Bluetooth and contactless payment is an important embodiment of the security and convenience of secure payment solutions. As the use of beacon technology grows, participants in retail shops, restaurants, public transportation, theaters, and other fields will be more involved in Bluetooth payment. In addition to Bluetooth-enabled contactless cards, the use of beacons can greatly improve accessibility for customers, which is designed to streamline transactions by allowing remote contactless payments.

Is Bluetooth a better go-to payment standard

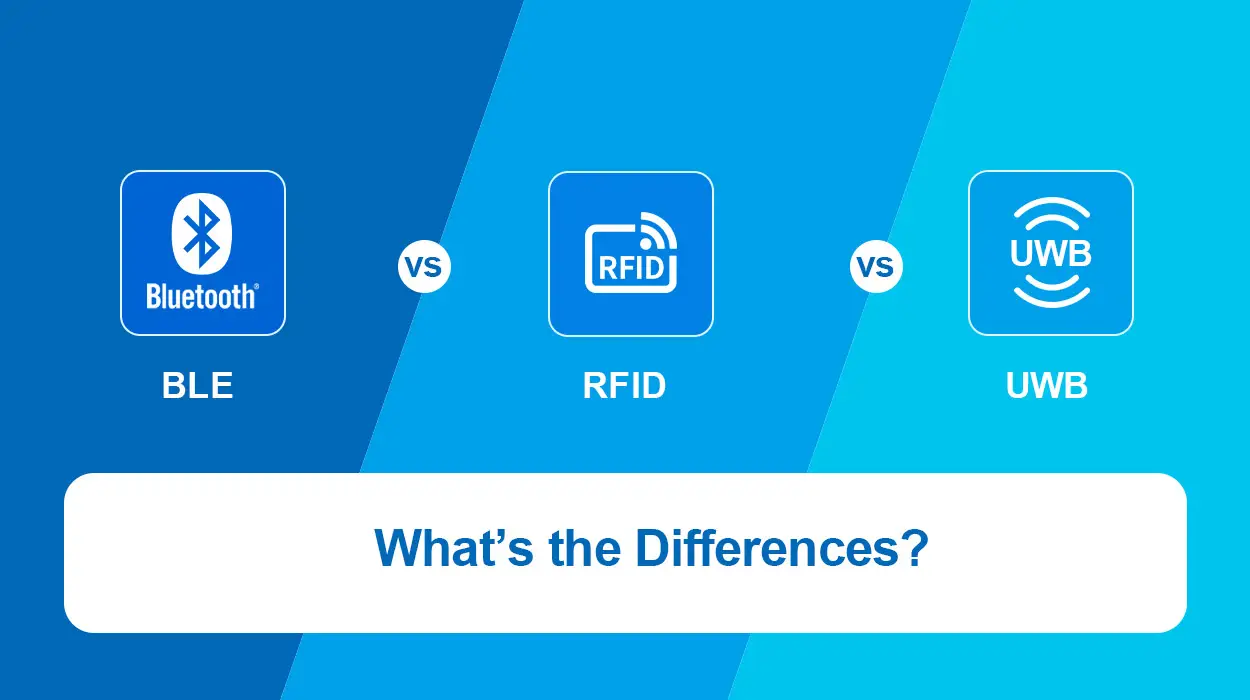

An interesting report made by Raydiant has found that about 80% of US consumers use contactless payment. It is clear that cash payments have been forced to take a step back, while contactless payment vendors are pouring in to meet the needs of modern businesses and consumers. While there are various contactless payments available, let’s explore how Bluetooth measures up against them.

- Platform independence. Since Bluetooth has been included before mobile phones got smart, it comes with the opportunity to conduct transactions with Bluetooth. To be precise, Bluetooth is a widely used standard that enables mobile applications to provide similar experiences to consumers regardless of their smartphone model.

- Payment freedom. Rather than NFC, Bluetooth works at a much longer distance up to 50 m, which allows transactions to be completed flexibly. For QR code, it requires a high-quality camera and online connectivity to deliver the transaction.

- Transaction Speed. The BLE payment standard has a faster processing time of less than 0.003 seconds, while the NFC requires 0.1 seconds for payment processing.

- Network Effect.NFC is essentially a one-to-one communication standard, while BLE provides a one-to-many connectivity, allowing merchants to handle multiple transactions simultaneously.

What are the benefits of BLE mobile payment

The era of the mobile internet has subverted the lifestyle in that of the desktop era and created a new mode of information dissemination and business model. What you have never imagined before – making purchases without cash, becomes a reality, which is a result of technological development. In fact, you can enjoy more than making cashless payments with BLE technology. Anyway, the following section will show you some critical benefits.

Available card-not-present transaction

Beacon-based mobile payment is a welcome change for customers as it removes the hassle of rummaging your wallet for cash and card while making a transaction. Every customer is available for a card-not-present transaction without having to stand in line. Thanks to BLE, it is possible to connect to a POS terminal or the cloud from anywhere in the store, even in crowded indoor venues.

Improved check-out efficiency and sales

There’s nothing your customers hate more than waiting in long lines to check out. Quite a few customers prefer to use mobile payment services, and they are likely to spend more money there. Bluetooth payments simplify transactions by allowing contactless payments from a distance, rather than queuing at a fixed terminal to check out. As opposed to traditional countertop check-out, Bluetooth mobile payments give consumers more freedom of payment and improve payment efficiency.

Personalized shopping experience

Rewards programs and smartphone notifications are great ways to enhance the mobile payment experience. In this regard, beacon-based mobile payments are not only proven to be effective, but also help build brand loyalty as it gives brands the opportunity to interact directly with customers. BLE beacons allow you to send promotions, coupons or offers directly to your smartphone when you are nearby, giving you a customized shopping experience.

Compatible in a contactless environment

We all know that mobile phones play an important role in modern life and the usage of mobile phones is not slowing down. Bluetooth technology provides businesses and phone-carrying customers the accessibility, flexibility and autonomy for a contactless payment environment, giving them the option to exchange value with others. BLE contactless payment is opening up a whole new world of exciting possibilities, which delivers greater convenience and practicality in the trends of cash-to-card-to-mobile payment.

Challenges encountered by BLE contactless payments

Typically, with amazing technologies comes potential risks and challenges. Despite the innovative Bluetooth payment technology, some people remain reluctant to completely embrace it. Most of them believe that mobile devices are not secure enough to keep personal information safe. Still, the investment of fully implementing a BLE contactless payment solution is costly.

Privacy security concern

Personal privacy security has always been a concern of people. The long-distance BLE payment transactions make it easier for the secure data transmitted during a transaction to be interfered. If not compliant with the existing payment networks, personal information can be easily obtained by criminals through illegal means, which may cause information leakage and serious consequences.

Dependent on mobile phones

Due to the great power and convenience of smartphones, few people leave home with cash these days. However, it should be noted that BLE mobile payment is based on the smartphone platform. If your smartphone suddenly runs out of battery, gets lost accidentally, or disconnects from the Internet, the transaction won’t go through smoothly.

Investment in physical beacons

One of the essential requirements of the BLE beacon payment solution is that stores have to make investments in physical beacons. The investment cost of fully implementing a BLE contactless payment solution is rather high, which is manifested in the difficulty of reducing the chip size and price, weak anti-interference ability, too short transmission distance, and low information security. In addition, the disadvantage of the Bluetooth transport layer protocol is that it is inconvenient for the user to set the initial link between the devices.

Which business can benefit from Bluetooth payments

The BLE payment solution is far from a pie in the sky, and its pilots in the US and elsewhere have been so successful that payment providers like PayPal have fully integrated it into their systems. It is optimistic to say that BLE contactless payment is at the forefront of transforming the brick-and-mortar shopping experience. Here, we have selected some of the businesses that benefit from Bluetooth payments.

Retail store

When you make your way to the checkout counter after shopping, the Bluetooth e-Wallet sends a signal that there is sufficient balance on it. So you don’t have to rummage through your wallet to automatically pay for your purchases. The cashier will then send a signal back to your Wallet to update your card balance. With this wireless e-wallet, you can easily access the network of retail stores and supermarkets to automate shopping and electronic payments.

Restaurant

Any dinner experience can be streamlined with Bluetooth beacon as it essentially allows customers to walk into their favorite restaurant and pay without doing anything else at their table. Leveraging the power of beacons, mobile payment systems can be a very effective way for restaurants to communicate with customers, including ordering meals, calling service, etc. In addition, by deploying appropriate beacon locations, the restaurant can push promotional and special offers to consumers nearby.

Public transportation

In addition to financial payments, Bluetooth has also been successfully used in innovative public transportation payments. The Bluetooth beacon system, combined with a real-time mobile payment system, makes commuting easier. Not only can the riding records of passengers be tracked, but also the infrastructure and ticket processing costs are reduced. Contactless payment systems using BLE beacons can serve as the best way for public transport agencies to communicate with commuters, providing better service to passengers while collecting relevant passenger data.

Focus on the BLE hardware of MOKOBlue

The long-term vision for beacon contactless payments is to build an open platform where businesses can develop exciting and frictionless buying experiences for their customers. In any case, as a short-range communication technology that is well known to the public and has relatively high popularity, there is still room for imagination in the development of Bluetooth in the field of contactless payment. As a global leading Bluetooth solution provider, MOKOBlue has invested sufficient R&D resources in Bluetooth technology from hardware design to software development in line with the current industry development. If you have any BLE solution considerations, please contact our IoT expert!